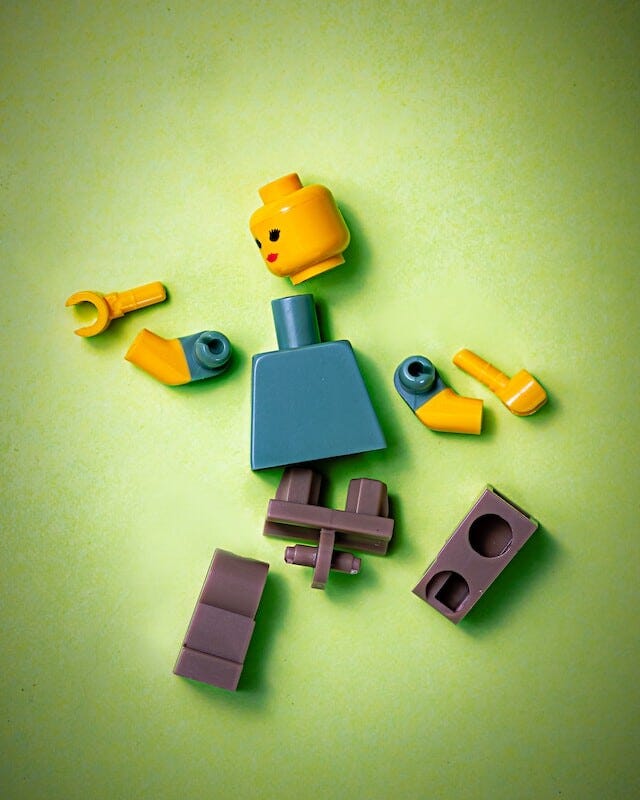

[RBM] - what a lovely chaos

Today's article is about how transformations typically happen in the real world. One great thing is that they do happen - organizations are constantly evolving, adapting, and improving their operations. However, the lack of control over these changes can create chaos in your company at best, or kill it at worst. Without proper governance and coordination, even well-intentioned transformation efforts can spiral into costly disasters that drain resources and demoralize teams.

Let's examine today's example that falls somewhere in the middle of this spectrum. It involves a small, anonymous bank - let's call it ABank for the purposes of this discussion. The bank's IT department recognized that significant changes were needed to continue operating profitably on such thin margins in an increasingly competitive financial services landscape. The focus was primarily on reducing IT system costs while maintaining operational efficiency. Since the bank was tiny, with only a handful of decision makers, this urgent message was easily communicated up the chain of command. They quickly decided the project should move forward without delay, viewing it as essential for survival.

IT prepared an ambitious backlog of changes across the entire IT system infrastructure and started implementing them immediately with enthusiasm. The changes were truly spectacular in scope, spanning from analytics systems and data warehouses through core banking platforms to customer-facing applications and mobile interfaces. The team was energized by the comprehensive nature of their modernization effort.

However, the market shifted dramatically midway through the transformation, making some of the planned changes unnecessary or even counterproductive. Business teams on the front lines recognized this shift in customer behavior and market conditions, but they didn't communicate it to IT in a way that would make them rethink their technical approach or reprioritize their roadmap. From a technical perspective, an entire layer of customer-facing systems needed complete redesigning to accommodate the new online-first way of meeting clients that had emerged during the pandemic. As you can imagine, IT started this additional transformation because it seemed relatively simple and would clearly benefit the organization's digital capabilities.

Then IT continued their original modernization efforts while business stakeholders simultaneously launched new cross-functional teams to implement fresh applications for incoming requirements they'd just identified through customer feedback. This was the first critical moment when synchronization broke down between technical and business teams, creating parallel workstreams that nobody was coordinating.

Fortunately, some of the more experienced engineers themselves recognized these overlapping activities and inefficiencies, and they eventually took the initiative to merge the competing initiatives. Of course, this merge wasn't ideal or seamless, making the entire transformation look somewhat messy and poorly planned from the outside. But the chaos and confusion didn't end there - it was just getting started.

A bigger international organization bought the bank during this tumultuous period. The new owners also acquired several other banks across Europe as part of their aggressive expansion strategy. They decided to unify all systems into one standardized platform to achieve economies of scale and operational consistency. They prepared a comprehensive roadmap for this massive integration initiative, complete with timelines and resource allocations. However, they didn't consult any of the smaller banks about their ongoing transformation efforts or existing commitments.

Our small ABank had reached the critical point of core banking system migration and started their expensive modernization process. They ran a competitive auction to find a new technology provider and hired specialized service providers for the complex modernization and migration work. Everything was progressing successfully according to plan until the new owner arrived and abruptly announced they would start migrating all bank data to their standardized core system as part of their predetermined roadmap. ABank's leadership was shocked and frustrated to learn that such a major initiative had been launched without their knowledge or input, effectively making their current efforts redundant.

Organizations spend enormous amounts of money on conflicting initiatives like these every day, often without realizing the cascading damage they're causing to their own operations. The lack of control and absence of a central source of truth make final results look like a complete mess, wasting precious resources and creating layers upon layers of technical debt. This will continue to plague teams for years to come. Different departments launch competing projects that overlap, contradict each other, or worse yet, actively undermine one another's goals. IT might be pushing one technology stack while operations champions another, and meanwhile, finance is questioning why they're paying for three alternative solutions that supposedly solve the same problem.

This is a perfect example of how you can spend significant money actually destroying your company's operational efficiency instead of improving it. It's like hiring multiple contractors to renovate the same house without telling them about each other – you end up with conflicting blueprints, duplicate work, and a less structure functional than when you started. The irony is that these initiatives are typically launched with the best intentions, but without proper coordination and oversight, they become expensive exercises in organizational chaos.

Transformations should be led by a virtual or real organization that controls what happens across all business units and continuously evolves the approach based on changing market conditions and business needs. This central authority needs to have both the visibility to see across silos and the authority to make binding decisions when conflicts arise. Without this kind of governance structure, companies will continue to throw good money after bad, creating more problems than they solve.